November 8 2016 was a historic day for India, when Prime Minister Narendra Modi took a bold and swift step, demonitising the highly circulated Rs.500 and Rs.1000 currency notes. Encouraged by the government, customers and merchants are looking for ways to exchange money without using cash. The change is gradual, but is headed the right way. Megacities like Mumbai, Bangalore and New Delhi have jumped at the chance and enabled plenty of businesses to go cashless. Second-tier cities like Pune, Indore and Coimbatore are slower, but are surely getting there one business at a time.

My cashless history

A decade before this landmark demonitisation move, I joined my first job in upscale South Bombay. In 2006, not even Information Technology engineers were ready to chuck cash. I was different. I was exposed to cashless transactions even back then. I had a high speed Internet connection at home and all my train and plane tickets were via Internet. My employer managed us from Los Angeles, so he used his Indian bank NRI account to wire us our salaries via NEFT. I had an ICICI bank account and one with State Bank of India, both of which already supported NEFT transactions. Other banks like Bank of Baroda and Canara Bank were yet to adopt digital wiring of money. They did support cheques.

For my commute, I used a Central Railway issued railway pass, which is a month-long or a quarter-long ticket between two fixed railway stations. Railway passes come at a highly subsidised rate and are a total hit with commuters who travel the same route everyday. For adhoc trips, I also had a prepaid stored-value railway card (called ATVM) wherein the cash transaction would be one-time, i.e. when adding stored value to the card. While not entirely cashless, it was still a way to ensure that I didn’t have to fish for change from my pocket or buy a railway ticket for every trip. I could use my stored value card and deduct the fare from it at the start of every trip. Central Railway also has a system where you can buy railway passes for a fixed route online and have it delivered to your home address, making the transaction fully cashless.

I had stored value & discount cards for cloth stores like Pantaloons and grocery shops like Reliance Fresh. I could redeem points from those cards. If I made purchases over a certain value, extra points would be credited to those cards and there were frequent loyalty points.

For a long time, Mumbai has had many shops / chains which accept credit cards, debit cards, vouchers and loyalty cards. I used that to my advantage. Priya, my wife, had a similar experience in her city, Chennai and continues to do so after her move to Mumbai.

When the demonitisation move was made and the government urged businesses to go cashless, Priya and I were fully equiped. We are using our credit cards, PayTM wallet and BHIM app wherever we could. Apart from being cashless, using these services has earned us plenty of discounts, cashbacks and reward / loyalty points. We have promised ourselves that we will teach people around us to use cashless options whenever possible, especially when they are willing, but don’t know how to.

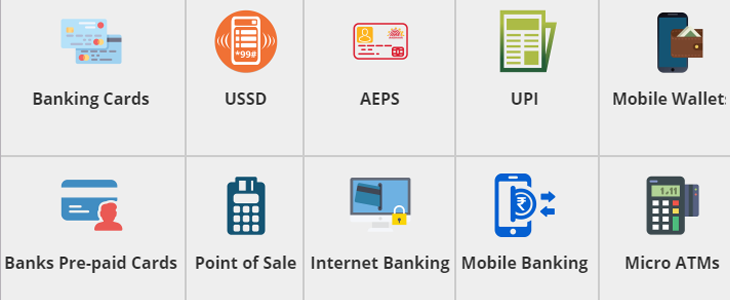

Let us start exploring our cashless options starting from the most primitive form to the start of the art.

Cheque / DD

This is a tech blog, but I include cheques and demand drafts for the sake of completeness. They have been around for centuries. The purpose of these instruments is to deduct a fixed amount from your account to the account of the payee. However cheque payments can fail if your account has insufficient balance. DDs are created directly by the bank at your request and will only be created if your account has the required amount. Once created, the amount will be blocked from your account and cannot be used for other payments.

Cheque and DD are cashless, but not paperless. It takes 24 hours or more for the money to change hands.

Stored value cards

This method is used by public transit companies and by brands that want to build loyal customers. Public transit companies issue cards so that commuters can purchase a fixed number of trips before hand. Each trip taken by the commuter reduces the fare amount from the card until the value is exhausted. Companies often attract commuters with bonuses, i.e. more stored value that what the customer pays for. Brands have a similar approach for gift cards / loyalty cards, so that they get repeat customers. To attract customers, they offer more value that what the customer pays for. They also award extra value for purchases above a certain amount and special credits for festive seasons. Card holders often get discounts which regular shoppers do not.

Stored value cards are of two types which enables its value to be refilled from different locations.

- If a card’s chip stores the value directly, then it needs a special device which writes a refill directly to that chip. You cannot refill such as card online and will need to visit the nearest facility who can refill it for you. E.g. Indian Railways’s ATVM cards need to be refilled at railway station counters or by authorised railway agents who possess the device that can perform a refill.

- If a card’s value is stored at a central location on a network, then it can be refilled in a number of ways. A perfect example is a prepaid phone SIM card. One can top it up online, use mobile wallets, use a scratch card, use phone banking and tens of other ways. This is also the case with loyalty cards at retailers. Sometimes you forget your card at home, but the re-assuring teller at the counter will ask you for the mobile number that you used to register with them, use that to find your card number and credit loyalty points to it.

Credit / Debit cards with a PoS (Point of Sale) terminal

Increasingly popular in India, PoS terminals have been around for two decades in every leading brand outlet. Interestingly, small businesses have adopted PoS terminals for the convenience of their customers. Local grocery shops, food trucks, medical shops and electronics goods shops have embraced PoS with increasing popularity. The advantage of this system is that it needs very little input from the customer and the merchant. The card is swiped in a slot on the terminal. The customer is asked to input the card’s PIN. If all goes well, the terminal’s connection to the bank is successful and the transfer of money between the customer’s card’s account and the merchant’s bank account is authorised. The disadvantage of this system is that fees charged by MasterCard and VISA for each transaction, which is 2.5% of the total purchase. Since 90% of India’s card payments are for domestic businesses (as per Wikipedia), it doesn’t make sense to pay foreign bodies like MasterCard and VISA so much money. India has come up with its own payment gateway called RuPay and and almost every bank has a card which routes money via RuPay. RuPay charges only 90 paise per transaction, regardless of the transaction amount. A fee of 60 paise is charged from the customer. The dealer is charged 30 paise. This total of 90 paise is one of the lowest payment gateway fees in the world.

Online purchase

Customers apply for credit / debit cards for two reasons. One is to pay via PoS terminals. The second reason is to purchase products and services online. India has seen an explosion of e-Commerce businesses. Amazon for just about every product, Myntra for clothes and Urban Ladder for furniture are some of the leading services in their respective markets online. Even if your town / city has not embraced cashless payments on a large scale, you can still use the Internet to buy using digital options like Netbanking, credit/debit cards and digital wallets. What’s more? With services like Furlenco (provides furnitures on rent) and Zoomcar (self driven cars on rent), it is even possible to rent commodities instead of buying them. And why not pay for travel through digital money? Think IRCTC, MakeMyTrip and Uber.

Digital wallets

A wallet is a space in which you can carry a limited amount of money that you know you will spend in the near future, say within the next month. This concept has been adapted to the digital world as well. The concept is less than a decade old in India. But within that time, we have seen hundreds of digital wallets grow in usage. PayTM continues to be the most popular wallet. Each bank has its own wallet account as well, e.g. Pockets by ICICI bank. Some telecom companies have started their own, such as Airtel Money, Jio Money, etc. As per RBI regulations, digital wallets can hold upto Rs. 10000 at a time.

But why use wallets when you can directly use credit cards or netbanking? And why choose one digital wallet over another? To answer the first question, wallet companies want to popularise their offerings by giving you, the customer, a vast variety of discounts or cashbacks. You are spoilt for choices to save your money. Discounts to book travel tickets, discounts for movie tickets, cashbacks for mobile phone topups and bill payments. The list goes on and on. The second question is best answered by seeing which services are supported by a wallet. PayTM wins here too. Almost every major service that can be purchased online accepts PayTM. Other wallets are growing slowly, but PayTM is way too advanced and widely accepted for now.

BHIM (BHarat Interface for Money)

So far, we have seen methods which require special hardware such as cards or PoS. We have seen netbanking & digital wallets which need an Internet connection, either broadband or 4G. The last method we will see is a very special method called BHIM. It is simple, advanced and can work even when there is no Internet connection. BHIM needs only two components: a bank account and a working mobile phone connection which is registered with that bank. Almost every Indian middle class citizen has a mobile phone and a bank account. Several of them have the same phone number registered with the bank. If not so, it is easy to do so in every bank. Once these conditions are met, you need to use the BHIM Android app or BHIM’s USSD service by dialling *99#. Preparing BHIM for usage has these steps.

- Let BHIM know your phone number.

- BHIM fetches all your bank accounts that are tied to that phone number.

- You choose one of those and set up a 4 or 6-digit PIN that is used to validate your future transactions.

Thats it! BHIM now uses your chosen bank account for all future transactions.

Paying with BHIM is even easier. You simply use the phone number of the intended recipient. That recipient will already have tied his/her phone number to his/her bank account. Alternatively you can use the combination of bank account number and IFSC code.

Transfer via BHIM incurs no charges. In contrast, a method like NEFT incurs a minimum of Rs. 5 per transaction in most banks.

The only caveat with BHIM is that one transaction cannot be more than Rs. 10000 per day. Nor can you transfer more than Rs. 10000 to a single recipient per day. The total limit on all transfers put together per day is only Rs. 20000. This makes it unviable to pay salaries and other big-ticket fees in a single transaction in a single day. But it is still usable for small transactions in small businesses. These limits will soon be raised to NEFT-like levels.

Conclusion

As you can see, India has no shortage of options when it comes to chucking cash. While cash is still important in the country’s economy, you do not need sufficient cash to get through the day anymore. In fact, Priya and I have had streaks of 7-8 days before we had to use any cash. Cheers to a cashless, hassle-free, modern and digital India.